- The S&P 500 has significantly outperformed the S&P/TSX 60 in recent years, driven by the dominance of U.S. technology giants.

- The S&P 500 trades at a higher valuation, raising concerns about future returns compared to Canada’s more value-oriented market.

- With energy and financials playing a key role in the S&P/TSX 60, a shift in market leadership could favor Canadian stocks.

Performance Gap: S&P 500 vs. S&P/TSX 60

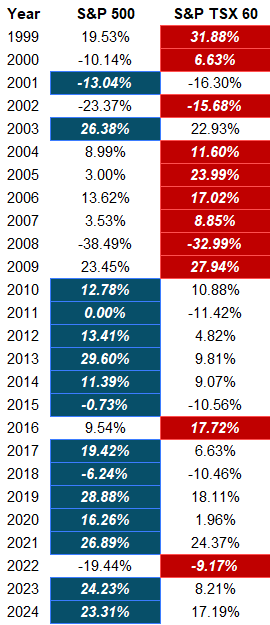

Over the past decade, the S&P 500 has outpaced the S&P/TSX 60 by a wide margin. Much of this outperformance has been fueled by the rapid growth of U.S. technology stocks such as Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA). These companies have driven the S&P 500 to record highs, particularly as artificial intelligence and cloud computing continue to expand.

In contrast, the S&P/TSX 60—the index that tracks Canada’s 60 largest publicly traded companies—has lagged. Although it contains many of the best Canadian stocks you can buy, Its performance has been weighed down by weaker technology representation and a greater reliance on cyclical sectors like energy and financials.

Valuation Disparity: A Reversal Ahead?

One of the key differences between these two indices is valuation. The S&P 500 currently trades at a price-to-earnings (P/E) ratio of over 22, while the S&P/TSX 60 remains closer to 20. This gap suggests that Canadian stocks may offer more value, particularly if high-growth U.S. stocks face pressure from rising interest rates or an economic slowdown.

Historically, when valuations become stretched, markets tend to revert to the mean. If U.S. tech stocks experience a correction or if energy and financials regain strength, Canadian stocks could see a relative outperformance.

Sector Breakdown: Strengths and Weaknesses

The S&P/TSX 60 is heavily weighted toward banks and energy companies, with major names like Royal Bank of Canada (TSX:RY), Toronto-Dominion Bank (TSX:TD), and Enbridge (TSX:ENB) leading the index. These companies offer strong dividend yields and stable earnings, but they lack the explosive growth potential seen in the U.S. tech sector.

Meanwhile, the S&P 500 is dominated by technology, representing a significant portion of the index. While these stocks have driven incredible returns, they also carry higher valuations and are more susceptible to market corrections.

What This Means for Investors

Investors looking for stability and dividends may find better opportunities in the S&P/TSX 60, especially given its lower valuation and exposure to sectors that benefit from rising interest rates. However, with the risk that tariffs and a trade war with the U.S. poses on many top Canadian companies, the next few years aren’t a slam dunk to be strong ones for the economy. Those seeking high growth may still prefer the S&P 500, despite its premium pricing, as it’s still home to the best stocks in the world.

With the valuation gap between these indices widening, a shift in market leadership could be on the horizon. If the U.S. tech rally slows or Canadian financials and energy stocks regain momentum, the S&P/TSX 60 could finally start closing the performance gap. But if you’re looking at the long haul, it’s hard to go wrong with the S&P 500, even if it is the pricier option today.