Author: SmartStocks.ca Staff

-

Air Canada Secures Tentative Deal With Flight Attendants After Three-Day Strike

Key Numbers Air Canada (TSX:AC) has struck a tentative agreement with its 10,000 flight attendants, ending a three-day strike that grounded hundreds of flights and disrupted travel for about 500,000 customers. The deal, reached after more than nine hours of mediated talks, introduces boarding pay for the first time—a major sticking point in negotiations—and provides Read more

-

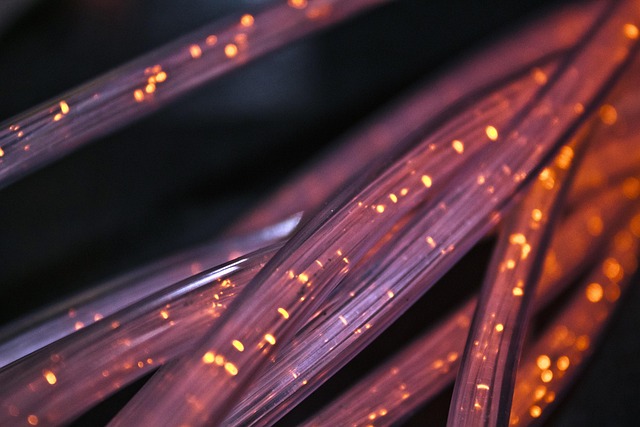

BCE Scales Back Canadian Fibre Expansion, Shifts Growth Focus to U.S.

Key Numbers from Q2 BCE Inc. (TSX:BCE)(NYSE:BCE) signaled a major shift in its network strategy after the federal government upheld the CRTC’s wholesale fibre internet policy. CEO Mirko Bibic confirmed that Bell’s Canadian fibre buildout — currently reaching eight million homes — will plateau, abandoning earlier targets of 8.3 to 9 million. The company argues Read more

-

Cenovus Delivers Strong Q2 Operations, Advances Growth Projects

Key Numbers from Q2 Cenovus Energy Inc. (TSX:CVE)(NYSE:CVE) reported solid second-quarter 2025 operational results last month, despite lower oil prices and planned maintenance. Cash from operating activities climbed to $2.4 billion, driven by efficient turnaround execution and working capital releases, though adjusted funds flow fell to $1.5 billion as production averaged 765,900 BOE/d, reflecting maintenance Read more

-

Enbridge Posts Record Q2 EBITDA, Expands $32B Project Backlog

Key Numbers from Q2 Enbridge Inc. (TSX:ENB)(NYSE:ENB) delivered a strong second quarter for 2025, recording record adjusted EBITDA of $4.64 billion, up 7% from last year, and reaffirming its 2025 financial guidance. GAAP earnings rose to $2.2 billion, or $1.00 per share, driven by higher contributions from U.S. gas utilities, favorable rate settlements, and colder Read more

-

Enphase Energy Slumps Amid Looming Tax-Credit Cut and Tariff Pressures

Key Numbers Enphase Energy (NASDAQ:ENPH)’s shares plunged after TD Cowen downgraded the stock to hold and cut the price target to $45, as President Trump’s directive to eliminate clean-electricity tax credits within 45 days of the new law clashes with looming tariffs on China-sourced battery cells. This double hit threatens to sap U.S. residential solar Read more

-

CoreWeave to Acquire Core Scientific in $9 Billion AI Power Grab

Key Numbers CoreWeave (NASDAQ:CRWV), one of 2025’s most talked-about tech stocks, has announced it will acquire Core Scientific (NASDAQ:CORZ) in an all-stock transaction valued at approximately $9 billion. Shares of CoreWeave have soared over 200% since its March IPO, fueling its ability to make a deal after an earlier bid was rejected. The transaction gives Read more

-

Amazon’s Prime Week Breaks Records, But Stock Reaction Remains Muted

Amazon (NASDAQ: AMZN) just wrapped up its biggest Prime Day event ever, delivering record-breaking sales across a newly extended four-day shopping window. U.S. consumers spent a total of $24.1 billion online during the week—a 30.3% surge from last year’s Prime window—yet the stock’s performance has barely budged, with Amazon shares up less than 3% in Read more

-

Can Loblaw Stock Be a Safe Buy Despite the Looming Tariff Risk in the Markets?

Rising costs and trade uncertainties have put pressure on many Canadian companies, especially those with exposure to the U.S. economy. Tariffs and supply chain disruptions have made it difficult for businesses to maintain margins, leading to volatility in the stock market. However, Loblaw (TSX:L) stands out as a relatively safe option in this environment. As Read more

-

Best Canadian Stocks to Buy for 2025

The TSX has been on a strong run this year, reflecting the resilience of the Canadian economy and the solid performance of key sectors such as energy, financials, and technology. Amid rising global uncertainty and fears of a potential market correction, many investors are reevaluating their portfolios. Focusing on value-oriented stocks can help mitigate risk Read more

-

Enbridge Increases Dividend by 3%

Enbridge announced today that it’s increasing its dividend by 3%. With the increase, the company has now raised its payout for 30 straight years. What’s also promising is that the company announced strong guidance for 2025. Not only does the company say that it’s on track to hit the high end of its guidance for Read more